Update: As of August 16th, the Inflation Reduction Act was signed into law. Read more for our breakdown on the impact that the IRA will have on carbon removal.

The Inflation Reduction Act (IRA) is the biggest federal climate deal in history. The revived reconciliation package is a result of negotiations on President Biden’s Build Back Better Act, and will bring the US significantly closer to our ambitious climate targets.

Giana Amador, cofounder and policy director, says:

Passing the IRA effectively transforms the 45Q tax credit, and, in turn, puts carbon removal startups and tech developers in a position to catalyze widespread deployment of DAC while also creating high-quality jobs. Put in the context of recent DAC policy wins, including the DAC Prizes and the Regional DAC Hubs Program, Congress has made a fundamental move to draw down legacy emissions.

The IRA also included big plus ups for agriculture and forestry, two carbon removal solutions that so far have gone underinvested and underappreciated. The IRA buoys long-standing, popular programs that support land managers in adopting new practices and retools them towards “climate-smart” practices.

Giana Amador

We dove into all 755 pages of the bill to identify the major wins for carbon removal across technological and land-based pathways.

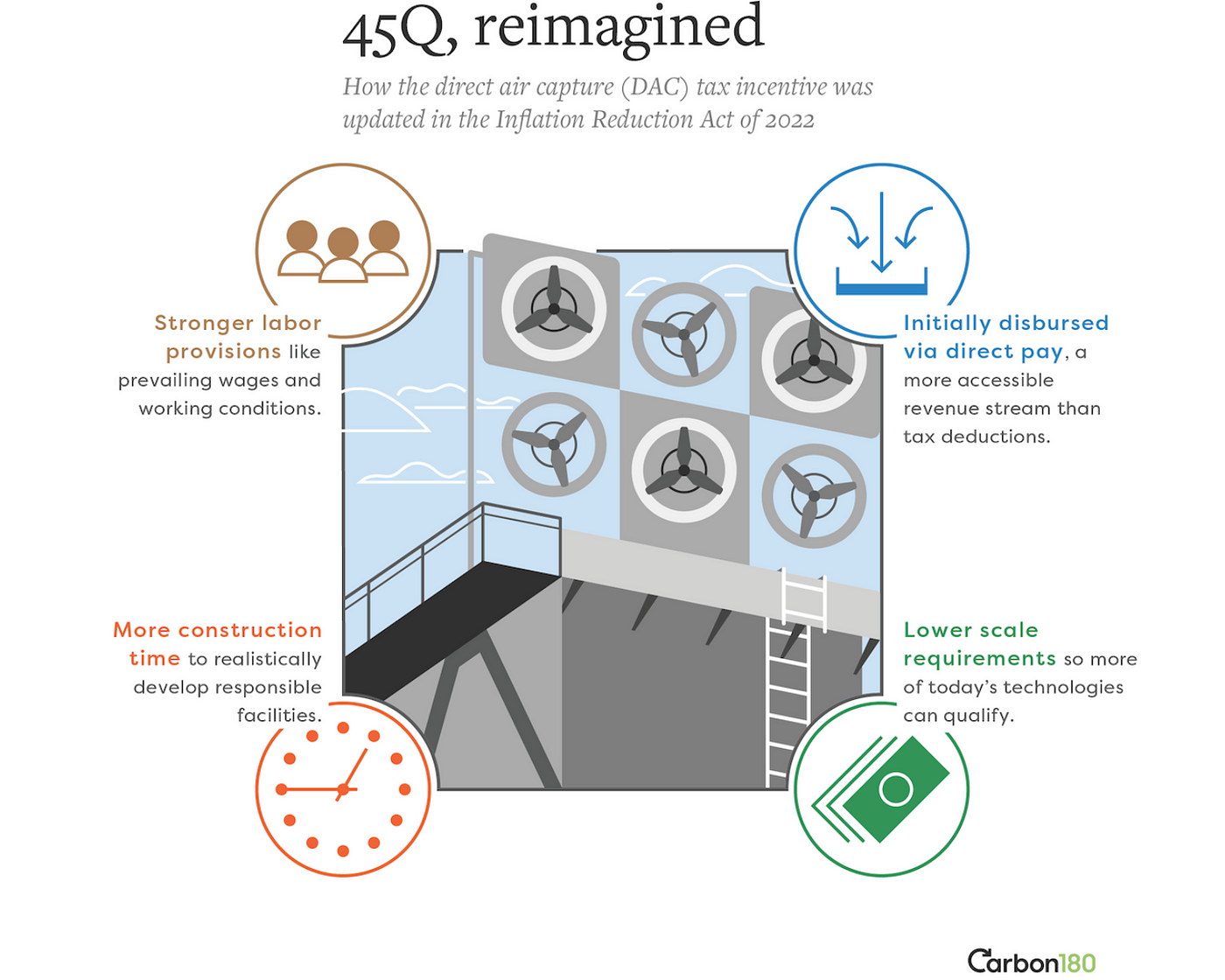

Transforming the 45Q tax credit

The IRA transforms the 45Q tax credit to better support carbon removal startups, and allows a wider range of project developers to take advantage of the credit.

- More time for construction. The IRA gives projects until 2033 to begin construction, creating a wider window in which the credit can be claimed.

- Right-sized removal requirements. Today, the largest operating DAC facility removes 4,000 metric tons of CO2 per year. The IRA reduces the qualifying threshold from 100,000 to 1,000 tons of CO2 per year, making the credit accessible to a wider array of startups and providing a revenue stream for smaller projects.

- Increased credit values. Currently, developers can get a credit of $35 per ton of CO2 sequestered through utilization and $50 for dedicated geologic storage. These credit values could be bumped up to $130 and $180, respectively — provided that developers meet certain labor standards, such as paying workers prevailing wages and offering apprenticeship opportunities.

- Direct payment to developers. Under the IRA, DAC developers can opt for direct compensation for credits generated in the first five years of operation instead of a reduction in their tax liability, allowing them to claim the full credit value.

Investing in agriculture

The IRA also includes historic investments in agriculture conservation incentives, technical assistance, and programs that address historical inequities.

Plus ups for incentives. The bill includes nearly $20 billion for USDA conservation programs that aim to support producers in adopting climate-smart practices while offering environmental and economic co-benefits. Interest in these programs has outpaced available funding, and these investments will help meet demand.

- Environmental Quality Incentives program: $8.45 billion

- Conservation Innovation Grants On-Farm Trials: $50 million

- Regional Conservation Partnership program: $4.95 billion

- Conservation Stewardship program: $3.25 billion

- Agriculture Conservation Easement program: $1.4 billion

Technical assistance and measuring success. The IRA supports farmers in implementing and accessing these programs by funding technical assistance and investing in data collection to assess the carbon sequestration outcomes of conservation activities.

- Conservation Technical Assistance program: $1 billion

- Data collection: $300 million

Equity in agriculture. There are also provisions to replace the farm debt relief program first included in the American Rescue Plan, as well as address inequities experienced by underserved farmers.

- Aid to distressed holders of guaranteed and direct loans: $3.1 billion

- Payments to farmers who experienced discrimination in USDA farm lending programs: $2.2 billion

- Assistance to underserved farmers, ranchers, and forest landowners: $125 million

- Funding to organizations that help improve land access for underserved farmers, ranchers, and landowners: $250 million in grants and loans

Protecting forests and natural land

By investing in the resilience and carbon-storing potential of private, public, and urban forests, the IRA reinforces the role that diverse forests can and should play in mitigating climate change and delivering co-benefits to underserved communities.

Research and innovation. The IRA includes increased funding for programs that support research, development, and demonstration to advance innovative, carbon-storing materials.

- Wood Innovation Grants: $100 million

Wildfire management. Practices such as the removal of overgrown vegetation and prescribed fires can help forests return to their natural fire cycle, protecting communities from wildfire impacts as well as carbon stored in fire-prone forests.

- National forest system restoration and fuels reduction projects: $2.1 billion

Private and state forest conservation and management. The IRA invests in support for underserved landowners and communities, providing a foundation for meaningful, forest-based climate action.

- Urban and Community Forestry program: $1.5 billion

- Forest Legacy program: $700 million

- Funding for underserved landowners to adopt climate mitigation or forest resilience practices: $150 million

- Funding for underserved and small forest landowners to participate in emerging private markets: $250 million

What’s next

The IRA aims to make impactful investments across technological, agricultural, and forest carbon removal, providing necessary funding to scale solutions and remove legacy carbon emissions. The bill will be voted on in the House at the end of August, after which it will make its way to the president’s desk. We’ll continue to explore the IRA’s impact as the bill goes through the legislative process.

Edited by Ana Little-Saña. Cover image by Karsten Würth.